In an age where AI-generated faces, deepfakes, and fully digital onboarding are becoming the norm, Face Liveness Detection has emerged as one of the most vital security layers for identity verification. Whether you're running a digital bank, a fintech platform, or a regulated Video KYC service, verifying that a person on camera is truly present — and not a spoofed or synthetic clone — is mission-critical. But how does it work under the hood? What types of spoofing exist? And what does it mean to be truly secure in an AI-fueled world?

This guide will answer all of that — and more.

What is Face Liveness Detection?

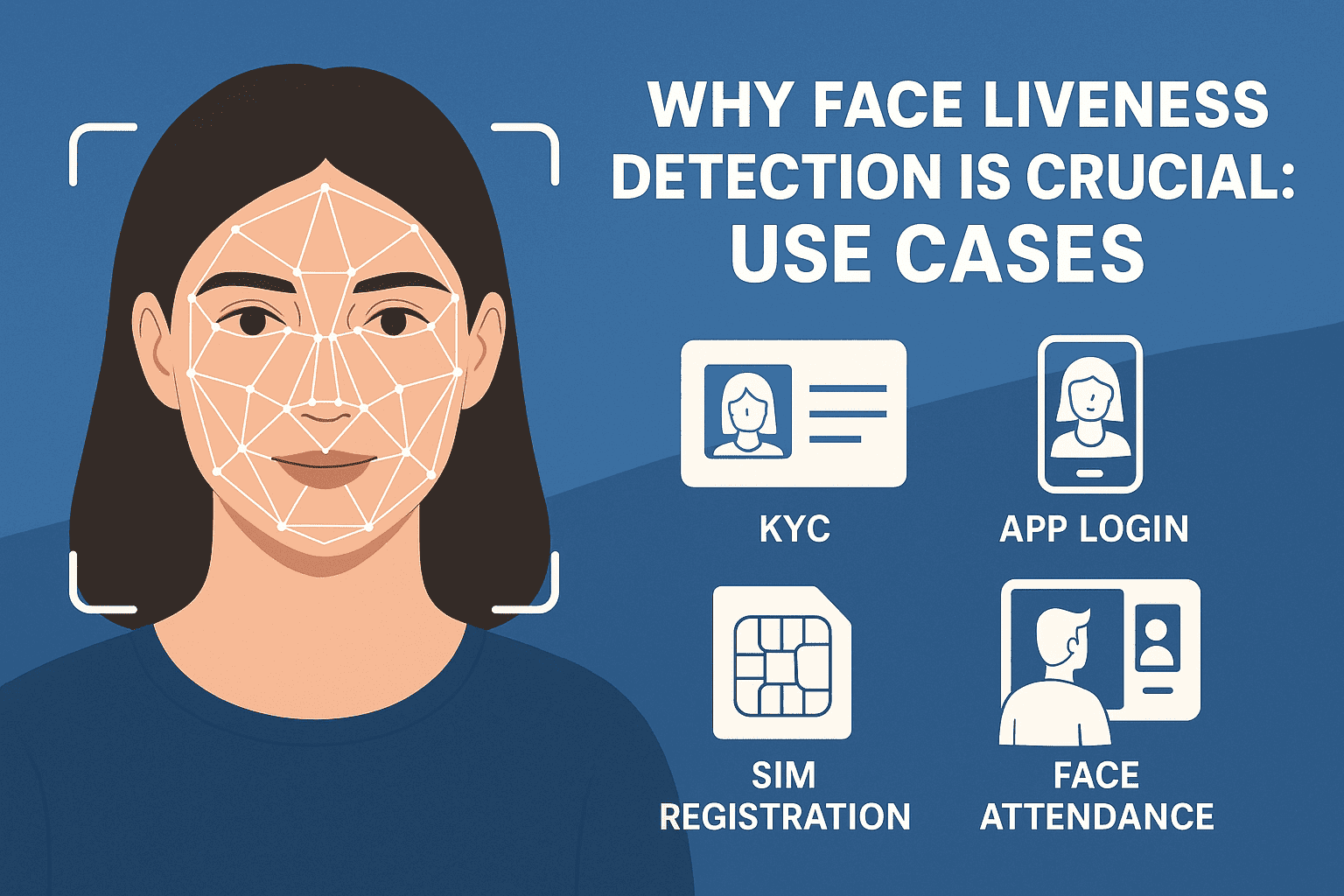

Face Liveness Detection is the process of verifying that the face presented to a camera is a live human being and not a spoofed representation such as a photograph, video, deepfake, or mask. It's a fundamental part of any identity verification or KYC process that involves facial recognition.

Without it, anyone can bypass your system by:

Holding up a high-resolution photo of someone else

Replaying a video of a real user blinking or nodding

Wearing a hyper-realistic 3D silicone mask

Using deepfake or face swap software to mimic someone else in real-time

Injecting a fake video feed directly into the camera input

Face liveness detection is built to prevent these attacks. It’s what ensures the person on the other end is real — not just a digital illusion.

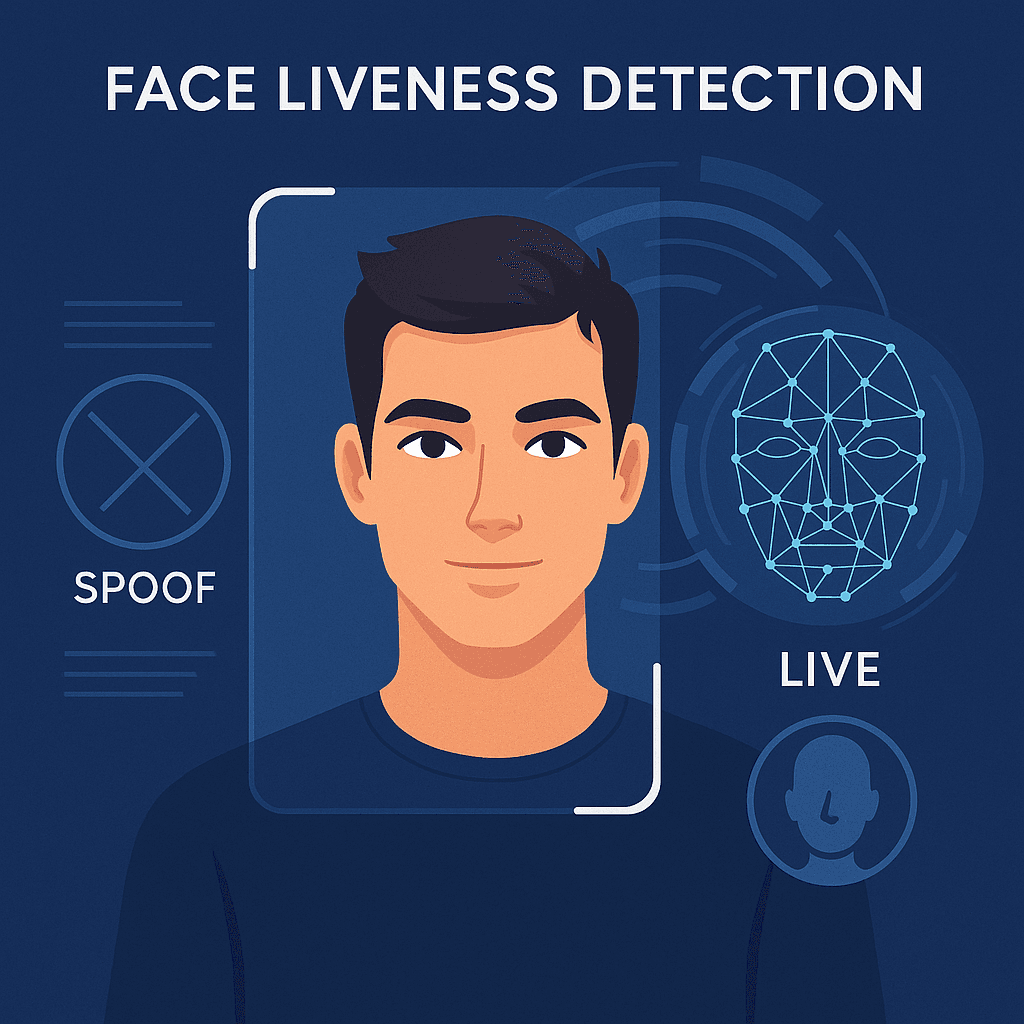

There are two major categories of liveness detection: Active and Passive.

Active vs Passive Liveness Detection: What's the Difference?

Feature | Active Liveness | Passive Liveness |

|---|---|---|

User Interaction | Required (e.g., blink, smile, nod) | None |

UX Impact | High friction | Frictionless |

Speed | Slower (5–7 sec) | Instant (≤1 sec) |

Attack Surface | Susceptible to replay/video attacks | More secure (analyzes subtle cues) |

Ideal For | Low-security environments | Banks, fintechs, government KYC |

Active Liveness Detection asks users to perform gestures like blinking, smiling, or turning their head. While simple to implement, it's also simple to spoof — attackers can easily replay a video of a user blinking or fake movements using animated photos or apps.

Passive Liveness Detection, on the other hand, requires no user interaction. It analyzes subtle facial cues, texture irregularities, depth inconsistencies, and motion dynamics to determine liveness. This means better UX, faster verification, and more robust fraud prevention.

Since internet connectivity isn't always ideal, passive liveness is becoming the de facto standard for enterprises and regulators alike. It avoids user drop-offs, reduces onboarding friction, and boosts conversion.

Types of Face Spoofing Attacks

Attackers are getting smarter, faster, and more creative. Here are the most common (and dangerous) attack types face liveness must guard against:

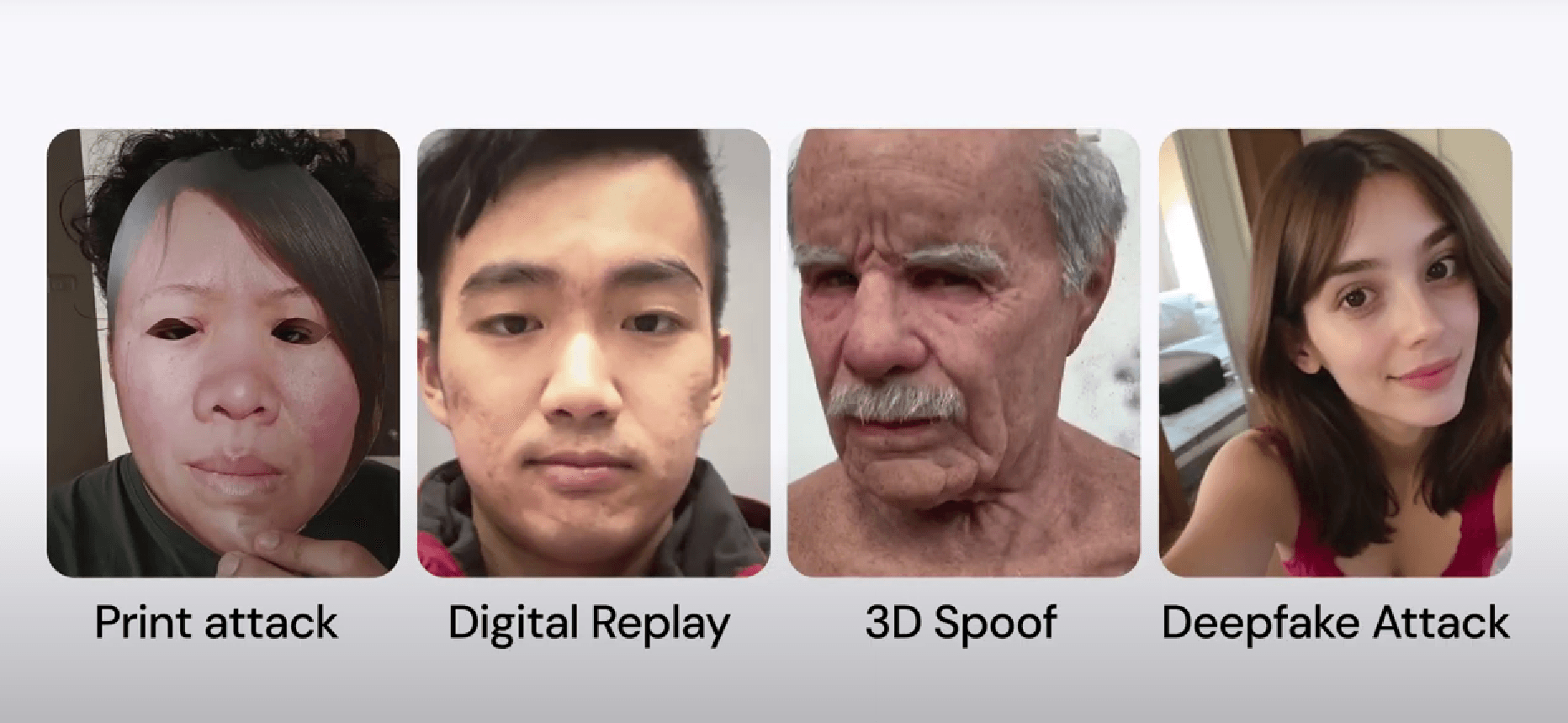

1. Print Attacks (2D Photo Presentation)

The attacker simply holds up a printed or digital photo to the camera.

Surprisingly effective against older systems that only check for facial landmarks.

Bypass rate: ~50% on naive or non-liveness-enabled face recognition systems

Still common in basic selfie verification tools.

2. Replay Attacks (Video Presentation)

The attacker plays a pre-recorded video of the genuine user blinking or smiling.

Often used in Aadhaar-based fake KYC scams across India.

Easily fools active liveness systems expecting specific gestures.

Real cases: In 2023, over 4,000 cases of replay fraud were flagged by private KYC vendors in India.

3. 3D Mask Attacks

High-end fraudsters use full-face masks made from silicone, latex, or plastic.

These masks mimic skin tone, depth, and facial features.

Can bypass systems relying solely on 2D or depth sensors.

Cost: ~$200–$400 on dark web marketplaces; can be custom printed.

4. Face Swap & Deepfake Attacks

AI tools like DeepFaceLive or Snap Camera let attackers swap their face with a target's in real-time.

Deepfakes now mimic expressions, lip movement, and lighting almost perfectly.

2024 data: Deepfake-based fraud rose 930% YoY worldwide according to Sensity AI.

Use cases: Financial scams, political impersonation, fraudulent onboarding.

5. Injection Attacks (Camera Feed Tampering)

Instead of showing the spoof to the webcam, the fraudster intercepts the camera input and injects a video or deepfake directly into the pipeline.

Completely invisible to humans and video reviewers.

Can only be detected by systems that monitor input integrity at the OS or browser level.

SpoofSense's API, for example, detects and blocks such attacks using stream integrity checks.

Why Liveness Detection Matters: The Financial and Regulatory Stakes

From a security engineering and regulatory compliance standpoint, face liveness detection is not merely a feature—it's a systemic requirement for digital identity verification systems that aim to be both secure and scalable. The threat landscape is evolving rapidly, with adversaries leveraging synthetic media, deep learning, and attack automation to exploit facial recognition systems.

According to data from Javelin Research, digital identity fraud led to an estimated $6.1 billion in global financial losses in 2023 alone. In India, where Aadhaar-based eKYC and Video KYC are widely deployed, over 17,000 Video KYC fraud cases were reported during the same period. These attacks commonly involved spoofing techniques such as printed photographs, replayed videos, and deepfake impersonations.

The financial services sector is particularly vulnerable. Banks, NBFCs, and Fintech platforms are prime targets because successful onboarding of a synthetic or spoofed identity can grant unauthorized access to loans, insurance, credit lines, and other high-value financial products. This not only results in direct financial loss but also regulatory scrutiny and loss of customer trust.

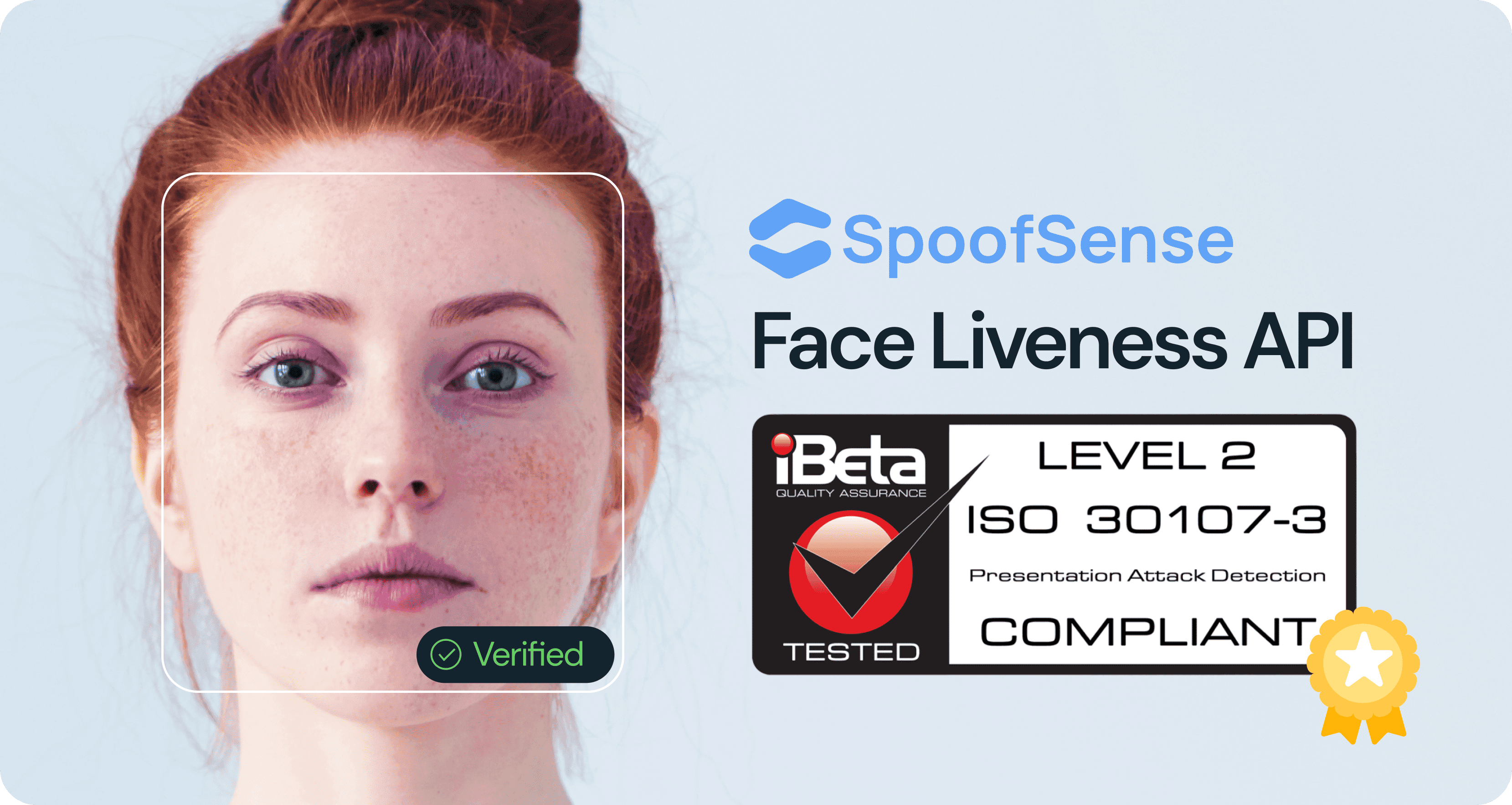

To mitigate these risks, regulatory bodies like the Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) have established compliance mandates that include the implementation of robust liveness detection during Video KYC. Furthermore, global benchmarks such as iBeta Level-2 certification are now being treated as the gold standard for validating the performance of passive liveness detection systems.

Put simply, failing to adopt reliable liveness detection can lead to:

Increased fraud liability

Non-compliance penalties

Damaged reputation and customer churn

For organizations operating in the identity verification ecosystem, liveness detection is no longer optional. It is a critical control point in a zero-trust identity architecture, and a core pillar of any secure, compliant onboarding workflow.

Identity fraud isn't hypothetical — it's already costing businesses billions.

$6.1 billion in global losses due to digital identity fraud in 2023 (Javelin Research)

Over 17,000 reported Video KYC fraud incidents in India — many using spoofing

Banks and NBFCs increasingly targeted due to high payout potential

RBI & SEBI require liveness checks for Video KYC compliance

iBeta Level-2 compliance is considered the global benchmark for passive liveness

A single breach can result in regulatory penalties, reputational damage, and customer churn. Liveness isn’t just a “tech upgrade” — it’s a business risk mitigator.

How SpoofSense.ai Helps You Stay Ahead

SpoofSense.ai offers a cutting-edge passive face liveness detection API, engineered for enterprise-grade security and Indian compliance needs:

iBeta Level-2 certified — meets highest global standards

Detects spoofs, deepfakes, injection attacks, and face swaps

Under 1 second verification — even on low-bandwidth networks

Requires no blink, no smile, no nod — ideal for rural and mobile users

Works with selfies, video KYC, and live camera feeds

Easy integration with REST API and on-premise SDKs

Whether you’re onboarding customers for lending, insurance, payments, or government benefits — SpoofSense ensures you’re onboarding real people, not impersonators.

Final Word: You Can't Afford to Be Fooled

As fraudsters get smarter, your verification stack needs to get smarter too. Face Liveness Detection isn't optional — it's your front-line defense against billion-dollar fraud threats.

With passive, gestureless, and ultra-fast detection, SpoofSense.ai gives your platform an edge — in compliance, UX, and fraud prevention.

🔒 Want to see it live? Book a demo and experience the difference.